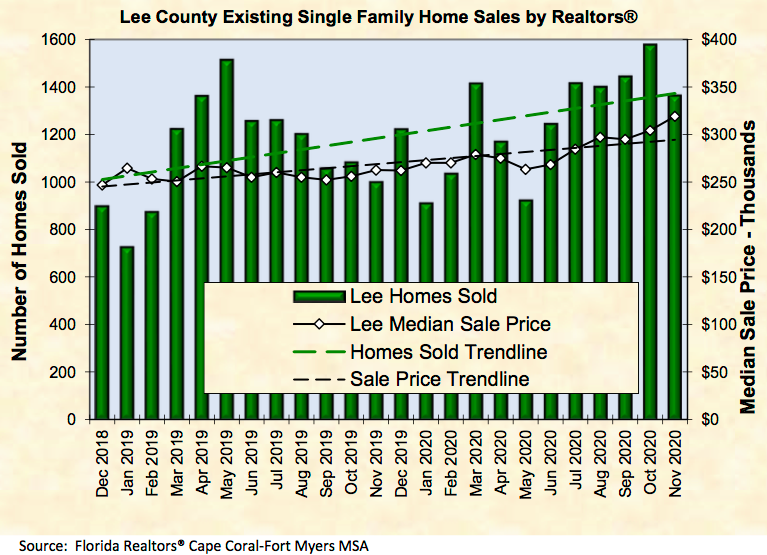

Florida Gulf Coast University’s Regional Economic Research Institute put together economic indicators and found single-family home sales in the region improved 43% in November 2020 over November 2019.

Real Estate indicators continue to be a bright spot for our region.

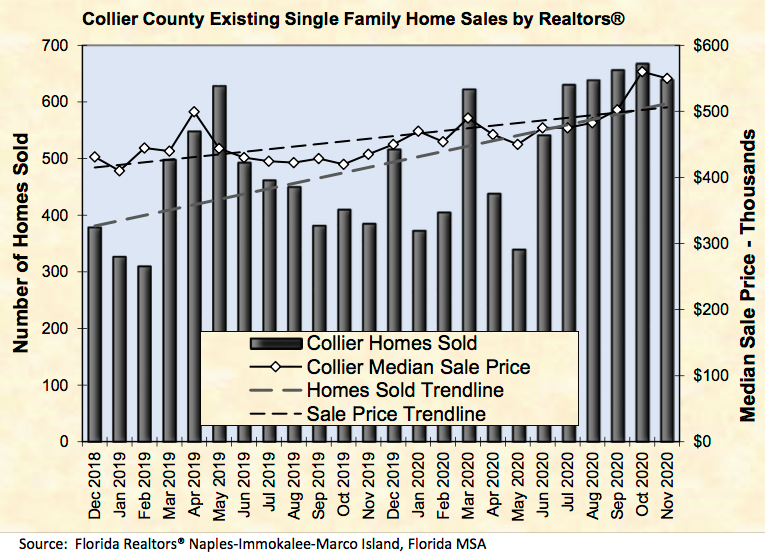

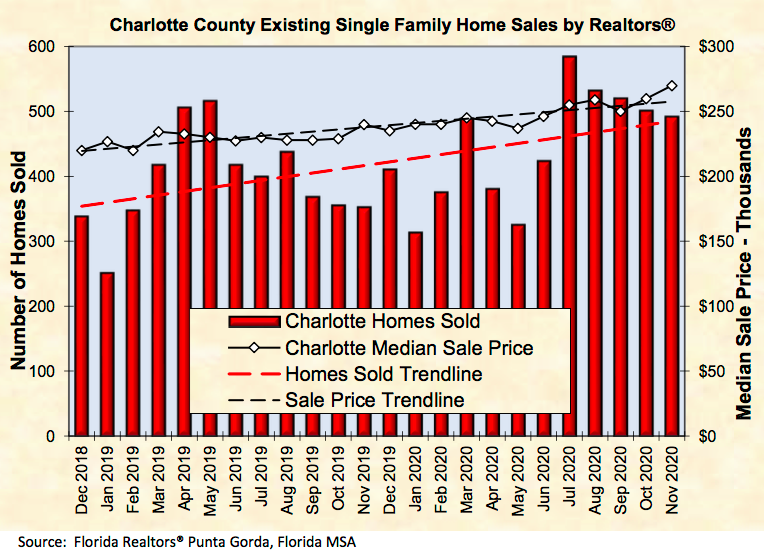

In Charlotte County, they are up 39%, Lee County up 36% and Collier County up 66%.

Median prices for single-family homes in Charlotte, Lee and Collier counties increased by 12% to 26% in November 2020 compared to November 2019.

In Charlotte County, the median home price went from $239,950 to $269,900. Lee County’s median price rose from $262,500 to $319,150 year over year.

Collier County saw the biggest jump over the same period, going from $435,000 in November 2019 to $550,000 in November 2020.

This price jump is unprecedented, according to Shelton Weeks, director of the Lucas Institute for Real Estate Development & Finance at Florida Gulf Coast University.

“When you look at the median home price in Collier County, it’s $550,000,” said Weeks, a real estate expert and economist. “Now, you don’t want to be in that situation, trying to recruit first responders, school teachers, nurses, people that we absolutely have to have. That’s a real challenge. So this sort of sets the stage for what I think will be some very important discussions regarding housing affordability, and how we can address this moving forward in order to maintain the quality of life.”

The recent real estate boom is the result of a few factors. Weeks suspects some may have accelerated their plans to relocate to Southwest Florida. In addition, record low-interest rates also make it tempting to buy. Right now, the average 30-year, fixed-rate mortgage is 2.67%, according to Freddie Mac.

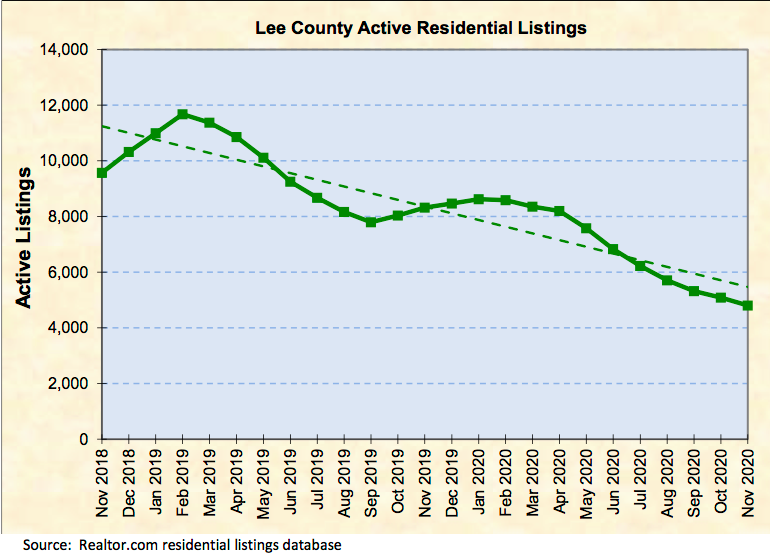

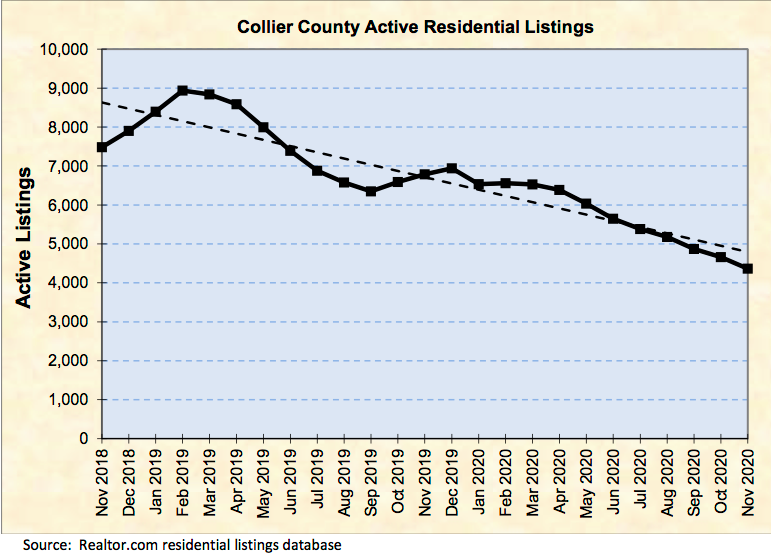

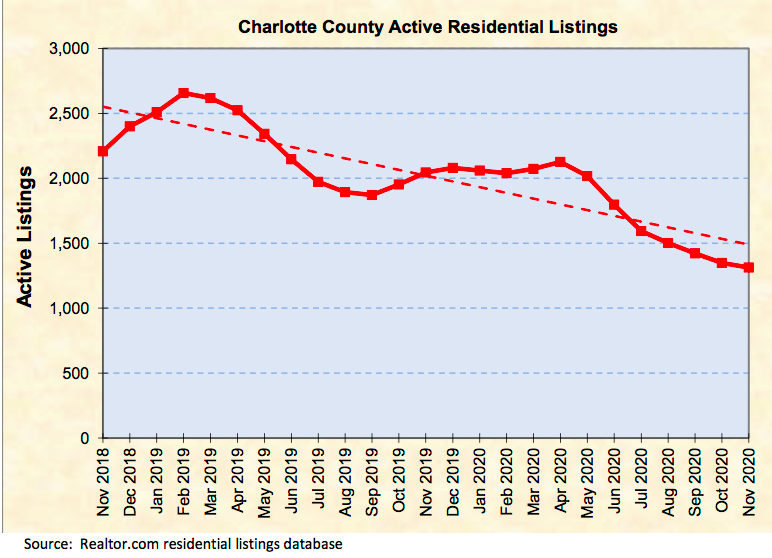

However, active listings for the coastal counties (Lee, Collier, and Charlotte) were down in November 2020, falling 39 percent from November 2019.

Other indicators provided some mixed results for the hospitality and tourism economy:

-

Airport passenger activity for November 2020 increased by 11 percent over October 2020, following the traditional seasonal pattern, but was 41 percent below the total for November 2019;

-

October 2020 seasonally-adjusted tourist tax revenues were 5 percent lower than October 2019, as well as 14 percent below the September 2020 total;

- Seasonally-adjusted taxable sales rose 7 percent in September 2020 compared to September 2019.

Source: https://www.fgcu.edu/cob/reri/rei/indicators202101.pdf