Despite increasing mortgage rates and rising insurance costs, Florida remains an attractive place for homebuyers. The state’s housing market is currently balanced, with neither buyers nor sellers holding a clear advantage. However, as inventory continues to grow, buyers may gain more negotiating power and find better opportunities to secure favorable deals.

Why It Matters

From 2023 to 2024, Florida’s population grew by 467,347, according to the U.S. Census Bureau. This surge underscores the state’s appeal, but it has also highlighted affordability challenges that make homeownership more difficult for many.

High home prices are a major factor, with Florida's median home price at $408,400, per Redfin. While this is below the U.S. median of $429,963, it is still higher than in other popular states like Texas and North Carolina. Rising mortgage rates have added to the strain, increasing monthly payments and stretching buyers’ budgets further.

Homeowners are also facing higher insurance costs, driven by inflation, natural disasters, and a spike in claims. These factors have made it harder for aspiring homeowners to enter the market, resulting in slower sales and a growing inventory of unsold homes.

What To Know

Experts suggest the Florida housing market in 2025 may shift to favor buyers. Increased inventory and declining home prices are key contributors to this trend. Hannah Jones, a senior research analyst at Realtor.com, told Newsweek that falling mortgage rates could accelerate this shift by removing another hurdle for buyers. Currently, Florida is considered a balanced market, but Jones notes that buyers now have the most favorable conditions seen in over five years.

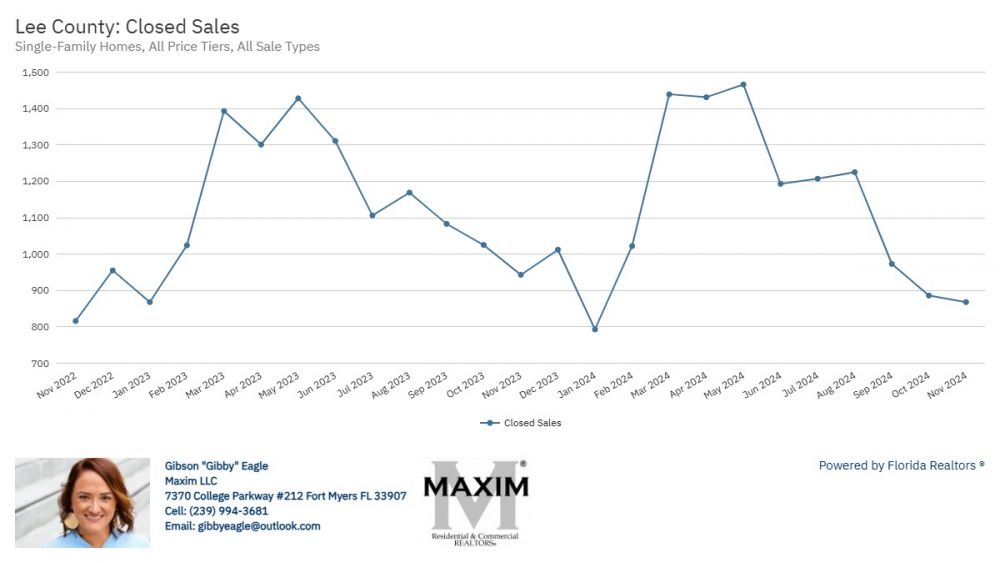

In November 2024, Florida home prices rose slightly by 0.9% year-over-year, with a median price of $408,400. However, sales activity slowed, with only 24,135 homes sold—a 7.9% decrease compared to the previous year. Meanwhile, the number of homes for sale increased by 22.2% to 198,627, creating an average of seven months’ supply.

Florida’s real estate market shows diversity in pricing and activity across different regions. Miami has some of the highest median home prices, while Jacksonville’s are among the lowest. Markets like Tampa Bay and St. Petersburg see quicker sales, while areas such as Port St. Lucie and Miami tend to have homes on the market longer. Jacksonville, Cape Coral, and St. Petersburg also saw notable sales activity, reflecting strong demand in these areas.

What People Are Saying

Hannah Jones noted that while Florida’s population growth typically increases housing demand, the rising inventory and falling prices suggest the market is well-equipped to handle the growth. However, she cautioned that if population growth outpaces inventory growth, prices could start climbing again.

What Happens Next

While some buyers may wait for the market to become even more favorable, others might act now. Florida ranked second in WalletHub’s study of the best places to live, and cities like Miami and Orlando are in Realtor.com’s top 10 housing markets for 2025.

Currently, 30-year mortgage rates hover around 7.00%, with experts predicting a slight drop to an average of 6.4% in 2025, according to Fannie Mae and the Mortgage Brokers Association. These conditions, combined with Florida’s strong rankings and economic appeal, may encourage some buyers to move quickly to secure their dream home in the Sunshine State.

Source: Florida Housing Market May Be Shifting: 'Add Gas To the Fire'