Mortgage interest rates surged today, hitting 4.2% a day after topping 4% for the first time IN YEARS.

A driving force behind the recent surge is high inflation, with the Bureau of Labor Statistics reporting a year-over-year inflation rate of 7.5% in January. That figure is the highest in 40 years, driven by increasing costs of energy and food.

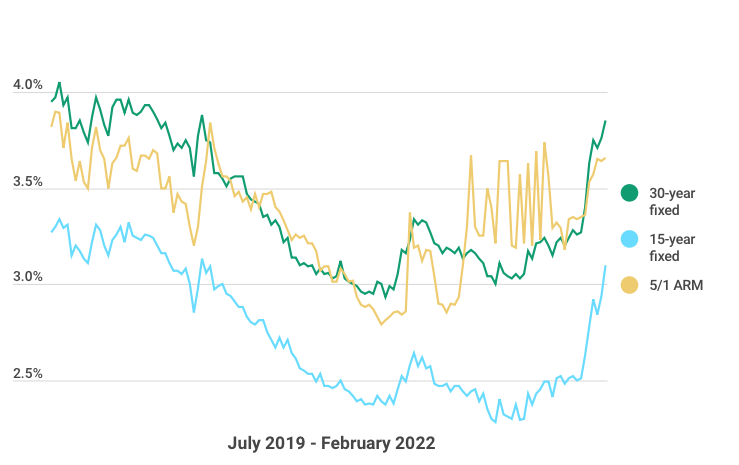

Rates have risen from below 3.3% at the start of the year in part due to the expectation that, to fight inflation, the Federal Reserve will start unwinding its policies designed to help the economy through the pandemic, including raising its benchmark short-term interest rate. Experts tell us rates remain quite low compared to historical standards. For homebuyers, a 4% rate might cut into your buying power a bit, but it shouldn’t be the deciding factor between buying a house and not buying one.

Take a look at today’s rates:

30-year mortgage rate: 4.20%

Today’s 20-year fixed mortgage rate is 4.18%

Today’s 15-year fixed mortgage rate is 3.51%

10-year fixed mortgage rates are averaging 3.46%

The average 5/1 adjustable mortgage currently sits at 2.87%

Where are mortgage rates headed?

Rates surged higher to start the year. Two of the factors causing rates to increase are high inflation and a recovering economy. But new Coronavirus variants, such as Omicron, have inserted a level of uncertainty into the markets and could potentially limit how high interest rates climb. Many experts expect to see higher mortgage rates by the end of 2022, and the Federal Reserve actions to address inflation could help fuel that increase.

What the mortgage rate forecast means for homebuyers:

Given how much goes into the decision to buy a home, the current mortgage rate trends shouldn’t have a large impact for most homebuyers. However, higher mortgage rates will drive up the cost of a home purchase and will impact how much house you can afford.

In 2022, the housing market is expected to moderate slightly, which is good for homebuyers. Even with a slight cold down in the housing market, it will still heavily favor sellers. Overall, home prices are forecast to rise, but at a much slower rate than what we saw in 2022. And overall rates should still remain historically favorable.

How to Get the Lowest Mortgage Rate:

Getting loan offers from a few lenders is one of the best ways to qualify for the lowest interest rate.

The mortgage rate you get depends on a variety of factors lenders consider when assessing how risky it is to give you a mortgage. Your credit score is a big part of this decision. And your loan-to-value (LTV) ratio is also important, so having a more substantial down payment is better for your interest rate.

But banks will consider your circumstances differently. So you can give the same documentation to three different mortgage providers, and receive mortgage offers with vastly different rates and fees.

Is Now a Good Time to Lock in My Mortgage Rate?

It’s impossible to know what direction mortgage rates will go from day to day. That’s why a mortgage rate lock is such a useful tool because it protects you if rates go up. And with interest rates being relatively low right now, you should lock in your rate as soon as you can.

When you lock in your rate, ask your lender how long the lock will last. A rate lock can be good for anywhere from 30 to 60 days, which typically will give you enough time to close before the lock expires. If you want to extend the rate lock, ask about fees as many lenders charge a fee for extending a rate lock.