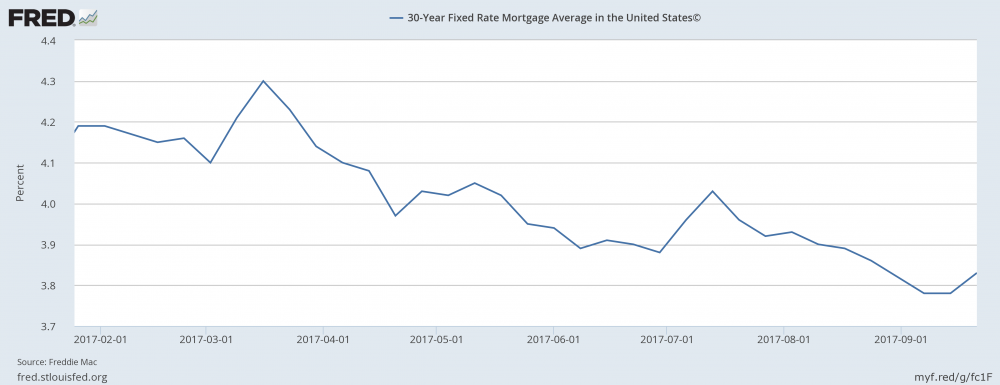

The rate on a 30-year fixed mortgage rises to 3.83% from 3.78%.

Home buyers beware: The cost of financing the purchase of a new home rose in late September for the first time in nearly two months.

(if you are on a mobile phone, flip phone to landscape view to view graph)

The interest rate on a 30-year fixed mortgage rose to an average of 3.83% from 3.78% in the week ended Sept. 21, according to Freddie Mac. That’s the first increase in seven weeks and reverses a steady drop in rates after they topped 4% in mid-July.

The rate on a 30-year mortgage is up significantly from 3.48% at the same time in 2016, but it’s below a recent peak of 4.32% last December.

The rate on a 15-year mortgage also rose by 0.5 point last week, to 3.13%.

The cost of financing a mortgage could also continue to rise.

The Federal Reserve is preparing to raise interest rates one more time in 2017 and three more times in 2018. What’s more, the central bank plans to slowly reduce the its huge holdings of mortgage-related loans and that could put some upward pressure on rates over time.