Chances are, if you are renting, you are paying too much for housing each month in comparison to your income. There is a long standing rule which states that you should not pay more than 2️⃣8️⃣% of your income on rent OR mortgage payment. This percentange allows for you to save for your future home purchase or to save for the future in general while comfortably covering other expenses.

Based on new data from Realtor .com, in 2017, 49.5 MILLION renters were cost burdened because they were paying over 30% of their monthly income on rent!

When your household is cost burdened, it is very difficult to save for the future and if your dream is to own your own home, it makes it very difficult to save for down payment, closing costs, and those unexpected fixes after move in.

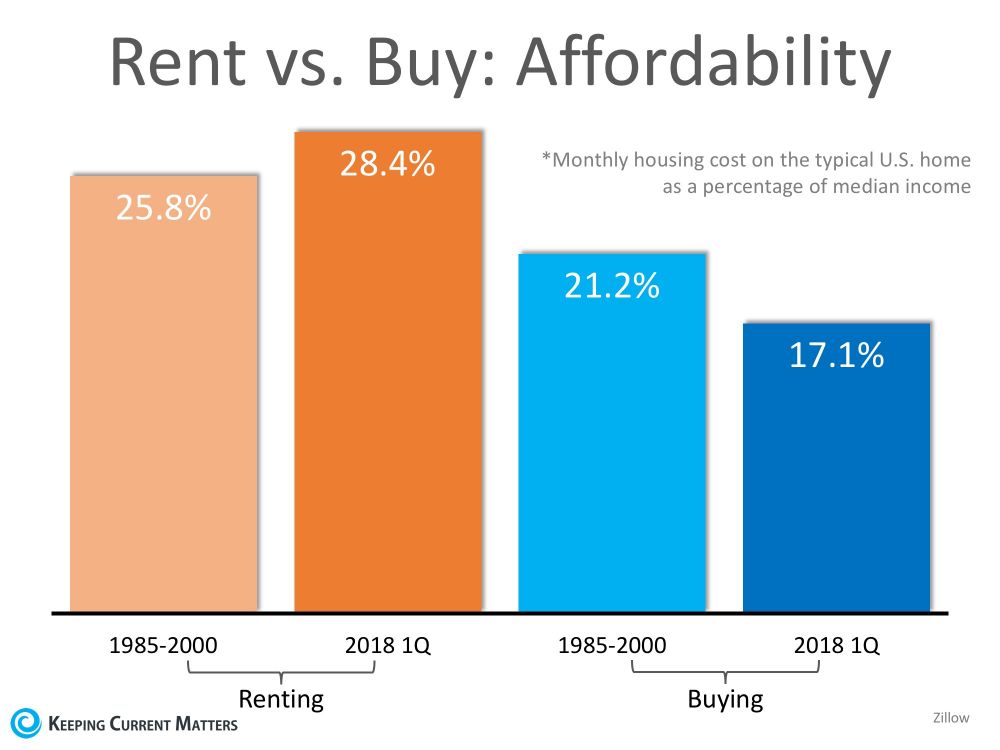

On the bright side, the income needed to buy a home is significantly less than renting (17.1%).

The chart above compares the historic percentage of income needed to rent and buy from 1985-2000 to the first quarter of 2018. As you can see, the cost of renting has climbed above historic numbers while the cost of buying dropped over the same period of time.

It's in your best interest to consider buying. If you are having trouble saving up to purchase a home, consider finding a roommate or moving into a more affordable rental (28% of income or less) so that you are able to comfortably save for your home purchase!